Why Pinoys Remain Top Owners of Crypto Globally

Several Filipinos entered the cryptocurrency space in 2021 after Axie Infinity and non-fungible tokens (NFTs) were popularized during the pandemic. However, when the hype subsided, many investors exited, especially during the bear market, which lasted more than two years.

Despite these challenges, Arlone Polo Abello, also known as Coach Miranda Miner, Founding Chairman of the Innovative Movement of the Philippine Association of Crypto Traders (IMPACT) and CEO of Global Miranda Miner Group, offered his perspectives on why many Filipino investors persist in investing and holding crypto, with a continuous influx of new participants joining the space.

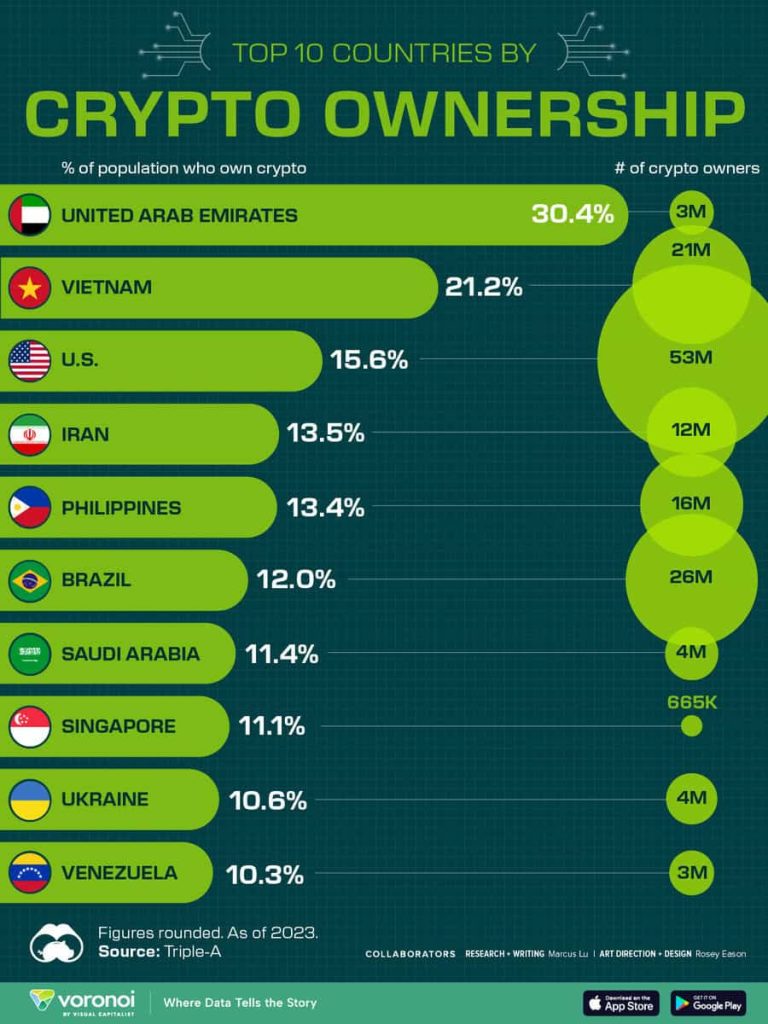

According to data from Visual Capitalist, the Philippines ranked fifth globally for cryptocurrency ownership.

Table of Contents

Crypto Usage on Remittance

According to Abello, the Philippines’ enthusiasm for cryptocurrencies is sustained by high remittance inflows, which form a significant part of the country’s gross domestic product (GDP). He highlighted that cryptocurrencies offer a cheaper and faster alternative for sending money home, appealing to both senders and receivers. Additionally, on-ramp and off-ramp apps facilitate easier cross-border payments with fiat conversion.

In 2023, remittances from Overseas Filipinos totaled 17.59 billion in the first half of the year, according to the Bangko Sentral ng Pilipinas (BSP). The central bank noted that this was a 3% increase from the $17.09 billion recorded during the same period in 2022. In July, PDAX CEO Nichel Gaba highlighted the preference of remittance companies for using Ripple’s XRP and stablecoins to transfer money to the Philippines.

Role of Tech Advancement and Adoption in PH

“In terms of technological adoption, the Filipino population is generally tech-savvy and quick to adopt new technologies. This openness extends to digital payments and cryptocurrencies,” Abello stated.

Further, according to Abello, the widespread use of mobile phones and growing internet penetration enhance the accessibility of digital transactions. “Cryptocurrencies, facilitated by mobile apps like Coins.ph and GCrypto, become a viable option for many Filipinos,” he added.

Abello also highlighted that the current economic conditions, such as inflation and currency devaluation, are diminishing the value of traditional savings, making cryptocurrencies appealing as alternative investments. He noted that the increasing presence of crypto exchanges and startups in the Philippines is also encouraging more Filipinos to adopt and invest in cryptocurrencies.

“Continued educational efforts from the government and public-private sector also contribute to this development,” he said, noting that their organization in IMPACT recently reached its 30th school to educate college students about cryptocurrency.

Articles about tech advancement, education, and adoption:

- Key Local Blockchain Communities Pushing For Adoption

- Seven Major Local Companies Embracing Web3 Technology

- Bitpinas Articles: Education

Influence of PH Government’s Stance

Abello reflected on the progressive stance of the Philippine government towards cryptocurrency regulation. He noted that the guidelines issued by the BSP for exchanges not only legitimize their operations but also help build trust among users. Additionally, he highlighted the positive impact of the BSP’s approval of Coins.ph’s stablecoin and the upcoming cryptocurrency framework from the Securities and Exchange Commission (SEC), expected by the second half of 2024.

“By recognizing cryptocurrencies under specific regulatory frameworks, the government provides a level of security and certainty that is conducive to adoption. Compared to countries with strict or unclear crypto regulations, the Philippines presents a more welcoming environment that likely contributes to higher adoption rates. However, this welcoming environment also requires more clarity, which we seem to be getting by 2024-2025,” Abello commented.

16M Pinoys Own Crypto

Visual Capitalist revealed that the Philippines ranked fifth globally for cryptocurrency ownership, with 13.4% of its population, totaling 16 million people, owning crypto.

Topping the list is the United Arab Emirates with 30.4%, followed by Vietnam at 21.2% and the United States at 15.6%. Other countries in the top 10 include Iran, Brazil, Saudi Arabia, Singapore, Ukraine, and Venezuela.

According to Visual Capitalist, it ranked the top 10 countries by their cryptocurrency ownership rates, reflecting the percentage of the population owning crypto assets. These figures are sourced from the crypto payment gateway Triple-A and are as of 2023.

Additionally, it’s noted that if countries were ranked based on the actual number of crypto owners, India would top the list with 93 million people, followed by China with 59 million, and the U.S. with 53 million. By this measure, the Philippines would be sixth in the rankings.

State of Crypto In PH

Currently, cryptocurrencies remain inadequately regulated in the Philippines, as the country has yet to establish comprehensive laws and regulations to govern the industry.

However, it must be noted that recently Securities and Exchange Commission (SEC) Chairperson Emilio B. Aquino said in an interview by BusinessWorld, that the Commission is set to release its crypto rules by the second half of 2024.

Further, Department of Finance (DOF) Secretary Ralph Recto previously announced that it is working with the SEC to develop comprehensive guidelines for regulating cryptocurrency registration and trading.

The Commission’s recent actions include requesting the National Telecommunications Commission (NTC) to block unregistered exchanges.

The BSP also has regulations that aims to regulate virtual currencies such as Circular No. 944 in 2017 which recognizes these currencies and requires exchanges to register and comply with AML/CTF regulations. Moreover, in 2021, the central bank also introduced updated guidelines for Virtual Asset Service Providers (VASPs), mandating licensing and emphasizing KYC and AML/CTF measures—though currently it is under a moratorium until September 2025.

Read: Global Regulatory Outlook for Cryptocurrencies 2024

In addition, the Philippines, although not a direct member of the Financial Action Task Force (FATF), adheres to its guidelines through its affiliation with the Asia/Pacific Group on Money Laundering, a FATF-Style Regional Body. These guidelines are crucial for the country in regulating cryptocurrencies and virtual assets to combat money laundering and terrorist financing risks.

The implementation of FATF’s Travel Rule in the Philippines mandates that VASPs obtain and maintain originator and beneficiary information for virtual asset transfers, ensuring compliance with international standards and safeguarding the integrity of the financial system.

Previous PH Crypto Ownership Ranking

In 2022, the Philippines ranked second in global cryptocurrency adoption, according to Chainalysis. Alongside emerging markets like Vietnam, Ukraine, India, and the United States, the Philippines demonstrates significant enthusiasm for cryptocurrencies. The report also highlights the presence of lower-middle-income countries such as Pakistan and Nigeria, as well as upper-middle-income countries like Brazil and Thailand, in the top 20 for crypto adoption.

In a 2021 Q4 survey by GWI, the Philippines ranked second globally for cryptocurrency ownership, with 22.7% of Filipino respondents using crypto. Turkey leads with 23.8%, followed by Argentina, Thailand, South Africa, Nigeria, Singapore, Indonesia, Brazil, and the United States. The survey targeted internet users aged 16 to 65, with men aged 25 to 34 representing 15.5% of crypto owners and women in the same age group at 10.4%.